This is how easily the focus can be shifted from punching to analysis

Fully automated invoice processing is both critical and essential. Many CFOs also have a strong need for data insights that provide a clear view of the company’s financial health.

It’s rare for the finance department to have more time than tasks, but once the SEMINE platform is implemented, the department often finds time to tackle long-desired strategic and business-critical tasks.

This is where the SEMINE platform excels: Traditional invoice capture only reads invoices at the header level, typically providing between seven to eleven data points per invoice. In contrast, SEMINE’s AI-driven solution can extract over 150 data points from an invoice by capturing information at the line-item level. These data points are automatically coded, giving you a fully classified data set with much more granular information than before.

A sea of possibilities

This opens up significantly more opportunities for finance teams aiming to work more strategically. SEMINE ensures that the information fed into the system is exactly what is on the invoice, providing a single source of truth for both large and small decisions. This leads to exponentially greater value creation from the data with minimal manual effort.

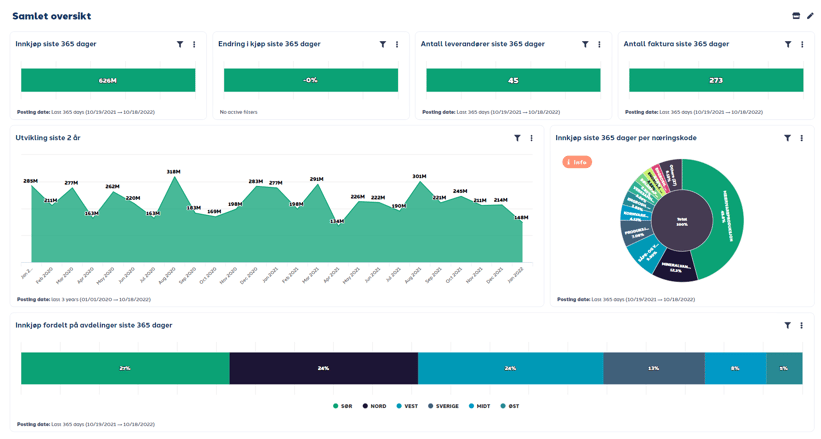

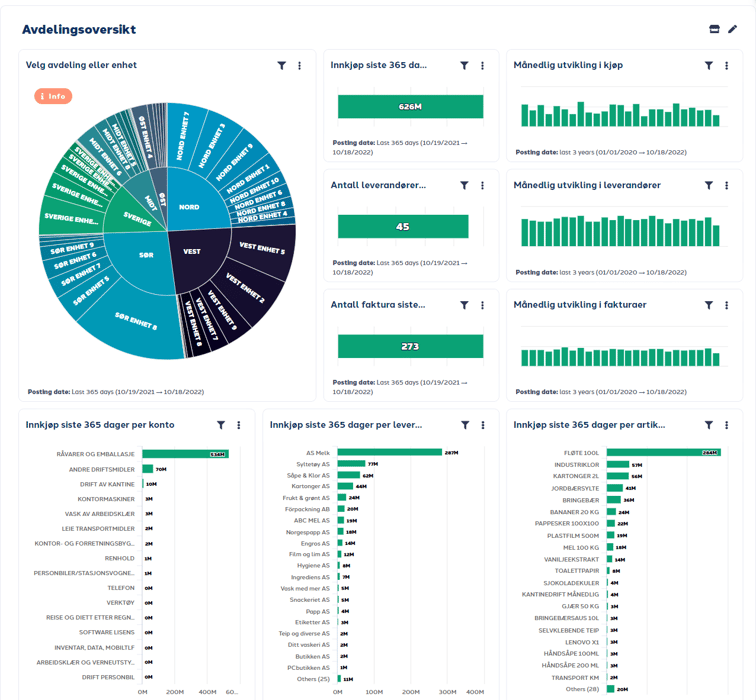

With more and better data points, you gain endless ways to visualize your business, consolidating information into a user-friendly dashboard. Below, you’ll see an example of a dashboard displaying financial and procurement status over the past 365 days.

Figure: Above, you can see the total amount of purchases made, the number of suppliers used, and the number of invoices received, as well as the areas where the most purchases have been made per industry code.

Insight and value

A SEMINE installation means the company suddenly has a data foundation that not only provides extensive information on price trends for raw materials and consumables, but also allows cost distribution by department, location, buyer, and a host of other factors.

READ MORE: Reduce costs and gain better control with AI-driven accounting

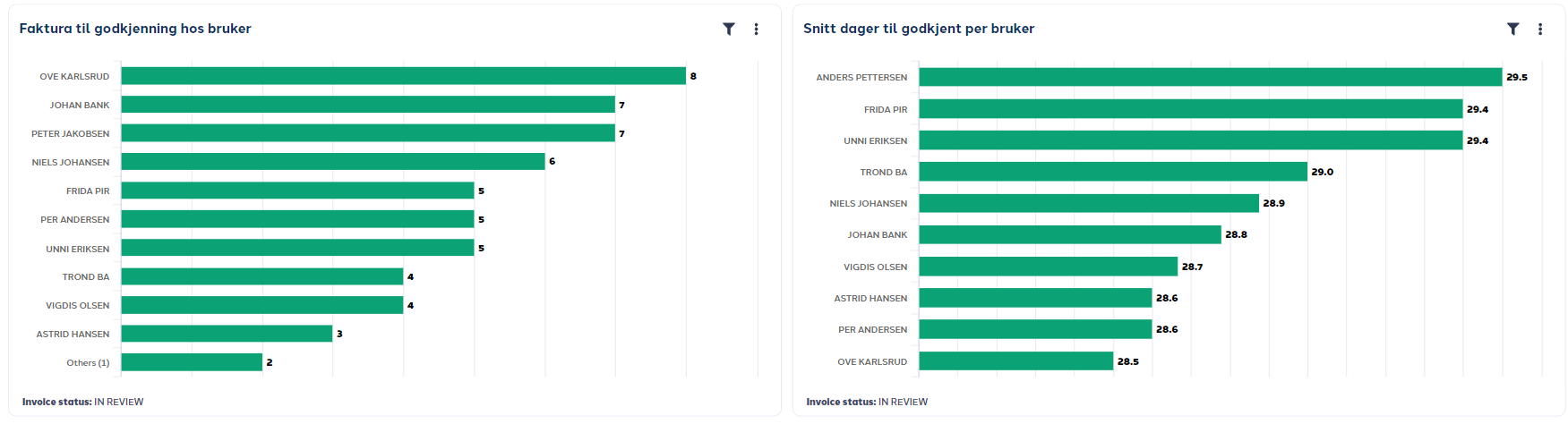

Imagine starting your day as a CFO or accounting manager with an updated, visual overview of the company’s liquidity and financial development. Graphs show cash flow and liquidity projections, while status indicators reveal how many invoices are awaiting approval and the average days-to-approval per user. If there’s a bottleneck, you can send reminders directly from the system with just a few clicks.

Figure: Here is an example that shows, among other things, the number of invoices awaiting approval per user, as well as the time it takes to approve invoices for each individual.

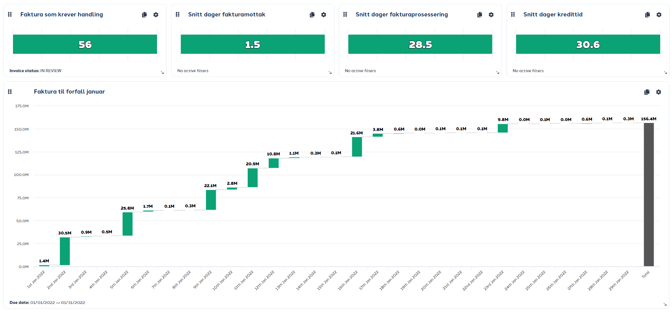

You might have defined a set of KPIs with your leadership team, which the dashboard can now give you complete oversight on.

Figure: Above, you can see an example where you can, among other things, view the number of invoices requiring action, the credit period, and the amount due in the next period.

Perhaps you’re monitoring accounts payable 30 days ahead, segmented by business unit, and matched against the purchase order system to identify discrepancies. Or you may want to ensure framework agreements are upheld, making sure purchases are made from the right suppliers and that discounts aren’t overlooked.

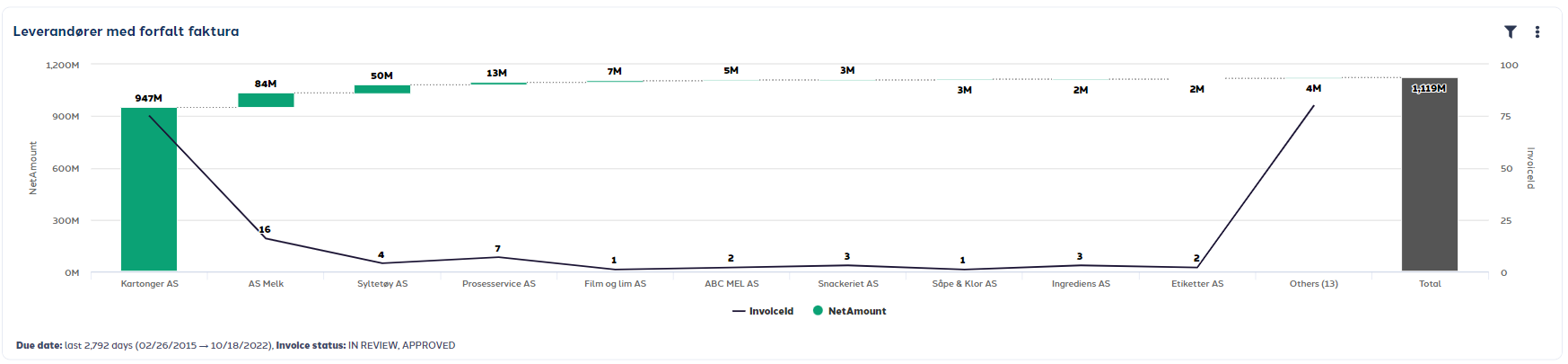

Figure: Above, you can see an example of how you can effectively identify and track overdue invoices by supplier.

Further investigation

Not everything requires constant monitoring, but having SEMINE in place provides a wealth of data that can be reviewed periodically.

For instance, you can easily track anomalies and analyze what went wrong. Does the invoice date match the actual delivery date? Is the billing in line with the agreed terms? Some suppliers offer cashback or early payment discounts for invoices paid within 30 days. Traditional financial systems make it cumbersome to verify whether your company is receiving such benefits.

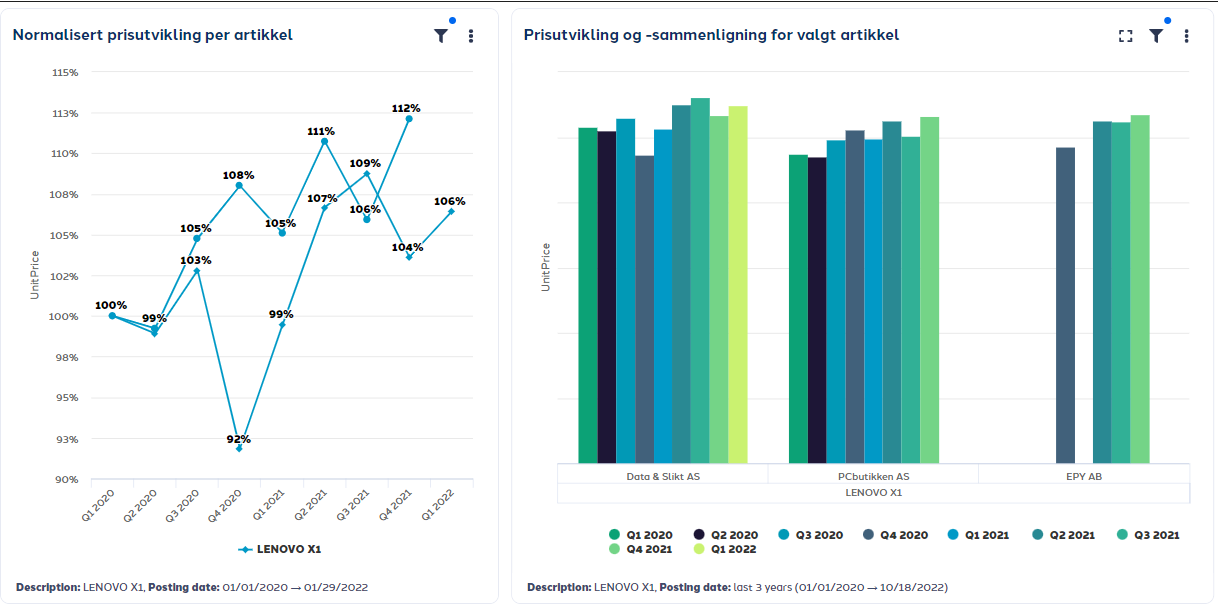

Figure: Above, you can see an example of how you can track the price developments of goods and services purchased and compare them across different suppliers.

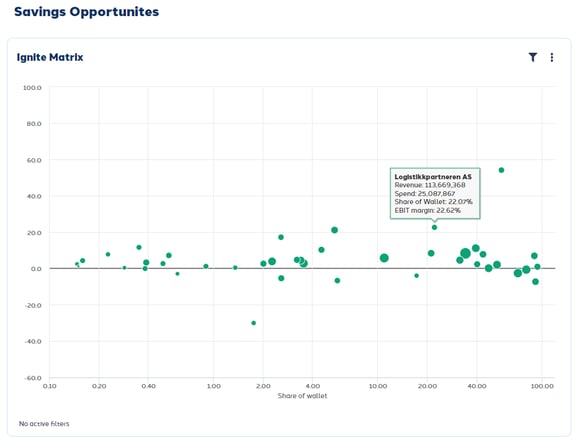

These savings can have a significant impact on liquidity. Additionally, the data foundation provided by SEMINE offers a completely new basis for negotiating future procurement contracts. Data from the platform can be analyzed in ways that reveal new opportunities, such as comparing supplier margins with how important your company is as a customer

Figure: Above, you can see the operating margin of a supplier combined with how important you are as a customer to this supplier.

And the organization gets to participate

For data to reach its full potential, it must be accessible to the entire organization. This goes beyond just opening a spreadsheet—it’s about visualizing the data in a dashboard that makes it easy to understand what should be prioritized at any given moment.

READ MORE: SEMINE Data

Dashboards can also be tailored to each department. Below is an example of a dashboard offering detailed insights into key parameters and KPIs for a specific department.

Figure: Here, you can see, among other things, purchases made in the last year distributed by account, supplier, and items. You can also observe the development of various KPIs, such as the number of suppliers, invoices, and purchases.

With this single source of truth, it becomes easier than ever to stay on top of issues, address minor irritations, and help the entire organization perform better.

This is one of the reasons why SEMINE, together with partners, works closely with customers to ensure they can fully leverage their data. In 2021, we signed a strategic partnership agreement with Ignite Procurement. By integrating SEMINE’s advanced invoice automation with Ignite’s unique methods for presenting data-driven insights, finance and procurement teams gain an incredibly powerful toolset for making data more accessible across the organization.

READ MORE: Semine and Ignite Procurement signed a strategic partnership agreement

In Summary

Your data and actionable insights are now more easily accessible than ever. While many companies have already begun this journey, many still have untapped potential.

See for yourself how SEMINE is revolutionising the finance sector. Book a 20-minute non-binding video meeting with us. We will assess your situation and needs while giving you the opportunity to see for yourself how SEMINE works through a brief demonstration.

%20(22).webp)